The Ultimate Guide To Medicare Advantage Agent

Table of ContentsNot known Facts About Medicare Advantage AgentNot known Details About Medicare Advantage Agent The Definitive Guide for Medicare Advantage AgentThe Definitive Guide to Medicare Advantage AgentThe Medicare Advantage Agent DiariesSome Known Questions About Medicare Advantage Agent.

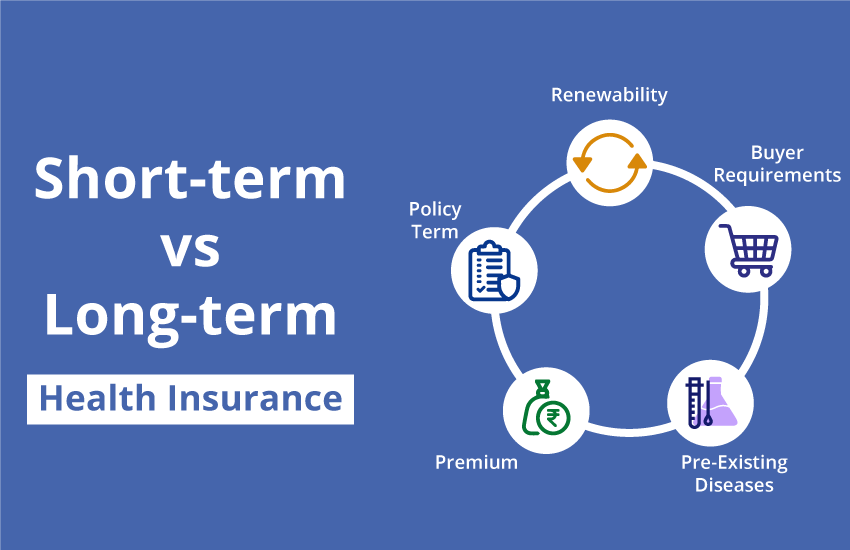

If the anesthesiologist is out of your health insurance's network, you will certainly get a surprise bill. This is likewise referred to as "balance invoicing." State and government regulations protect you from surprise medical bills. Learn what expenses are covered by surprise billing legislations on our page, Exactly how customers are protected from surprise clinical costs For more info about obtaining help with a shock expense, see our page, Exactly how to obtain help with a shock medical bill.You can use this duration to join the strategy if you didn't earlier. You can additionally utilize it to drop or transform your insurance coverage. Strategies with higher deductibles, copayments, and coinsurance have lower premiums. However you'll have to pay even more expense when you get treatment. To learn a firm's monetary rating and problems history, call our Aid Line or see our site.

Call the marketplace for more details. If you purchase from an unlicensed insurance provider, your claim could go unpaid if the business goes damaged. Call our Customer service or visit our site to inspect whether a firm or representative has a license. Know what each plan covers. If you have physicians you wish to keep, ensure they remain in the plan's network.

Not known Facts About Medicare Advantage Agent

Likewise see to it your medicines are on the plan's list of approved medications. A strategy won't spend for medications that aren't on its list. If you lie or leave something out deliberately, an insurance company may terminate your insurance coverage or refuse to pay your cases. Use our Health insurance shopping overview to shop smart for wellness protection.

There are different guaranty organizations for various lines of insurance coverage. The Texas Life and Wellness Insurance policy Warranty Association pays insurance claims for medical insurance. It will pay cases up to a dollar limit established by regulation. It doesn't pay cases for HMOs and some other kinds of strategies. If an HMO can't pay its claims, the commissioner of insurance policy can assign the HMO's participants to another HMO in the area.

Your spouse and youngsters likewise can proceed their protection if you go on Medicare, you and your partner divorce, or you pass away. They must have been on your prepare for one year or be younger than 1 years of age. Their protection will finish if they obtain other protection, do not pay the costs, or your employer stops offering health and wellness insurance.

More About Medicare Advantage Agent

You must tell your employer in writing that you want it. If you continue your coverage under COBRA, you must pay the premiums on your own. Your company doesn't have to pay any of your premiums. Your COBRA insurance coverage will certainly be the very same as the insurance coverage you had with your company's plan.

As soon as you have actually enrolled in a health and wellness strategy, make certain you understand your plan and the expense implications of various treatments and solutions. Going to an out-of-network physician versus in-network generally costs a consumer a lot a lot more for the exact same type of solution (Medicare Advantage Agent). When you enlist you will certainly be offered a certificate or evidence of coverage

The Of Medicare Advantage Agent

It will also tell you if any type of solutions have constraints (such as optimum amount that the health insurance plan will pay for resilient clinical devices or physical therapy). And it ought to inform what services are not covered in all (such as acupuncture). Do your homework, study all the options readily available, and examine your insurance policy prior to making any type of choices.

The Best Guide To Medicare Advantage Agent

When you have a medical treatment or browse through, you normally pay your health treatment service provider (medical professional, health center, therapist, etc) a my sources co-pay, co-insurance, and/or Check This Out an insurance deductible to cover your portion of the company's costs. You expect your health and wellness strategy to pay the remainder of the expense if you are seeing an in-network provider.

Nevertheless, there are some instances when you might have to sue yourself. This could happen when you go to an out-of-network supplier, when the provider does not accept your insurance coverage, or when you are taking a trip. If you require to submit your very own medical insurance case, call the number on your insurance policy card, and the client support agent can inform you how to submit an insurance claim.

Several health insurance plan have a time limitation for how long you need to sue, generally within 90 days of the solution. After you file the case, the wellness strategy has a minimal time (it differs per state) to educate you or your copyright if the health insurance plan has actually approved or rejected the insurance claim.

Get This Report about Medicare Advantage Agent

For some wellness plans, this clinical necessity decision is made prior to treatment. For other wellness plans, the decision is made when the firm gets an expense from the service provider.